Many friends around me have wanted to join the American Etsy platform, as there are few Chinese merchants and profits are abundant. However, Etsy is extremely averse to the practice of Chinese merchants flooding the market with large quantities of goods.

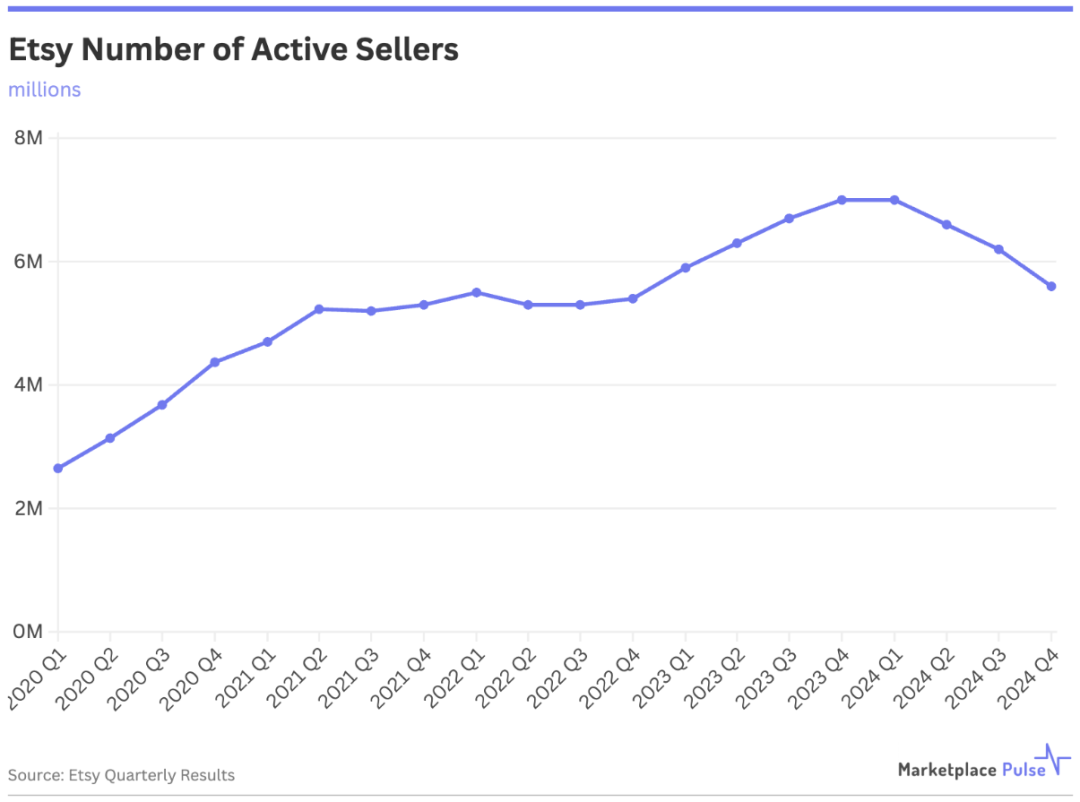

The latest news indicates that the number of active sellers on Etsy has declined for the third consecutive quarter.

The latest data shows that this number has dropped from a high of 7 million to 5.6 million. Most notably, between the third and fourth quarters of 2024, the number of active sellers (i.e., those who completed at least one sale last year) plummeted by 600,000. This trend suggests a significant contraction in Etsy's seller ecosystem.

Over the past year, the number of active buyers has decreased from 92 million to 89.6 million, and both quarterly and annual gross merchandise sales (GMS) have also seen slight declines. The drop in these three metrics indicates that Etsy is facing structural challenges rather than temporary fluctuations.

According to research by Marketplace Pulse, since its inception, nearly 14 million sellers have registered on Etsy, reaching a peak in 2021 with almost 3 million new sellers added. However, the number of new sellers joining each year has been declining sharply for three consecutive years, halving annually. During the pandemic peak, Etsy was adding over 300,000 new sellers per month. Current data shows that by 2024, this figure had plummeted to less than 20,000 per month.

Signs of recession? Etsy loses 1.4 million active sellers in a year

This downward trend contrasts starkly with Amazon, which continues to attract nearly one million new sellers annually without any signs of slowing down. Similarly, Walmart's marketplace continues to see rapid growth in the number of sellers, recently surpassing 150,000 active sellers.

As Etsy approaches its 20th anniversary in 2025, CEO Josh Silverman insists: "For two decades, Etsy has been a home for creativity and self-expression. In today's world of automation and commoditization, we believe our mission has never been more important."

This positioning directly challenges the 'no-brand' approach of platforms like Amazon and Temu.

While some of the seller attrition can be attributed to Etsy's efforts to clean up its platform by removing bad actors and counterfeit products, Silverman also acknowledges broader market pressures, noting that 2024 was "a challenging period for non-essentials." This challenge is reflected in Etsy's full-year net revenue decline of 1.4%.

The divergent fortunes of these platforms highlight fundamental differences in strategy. While Amazon and Walmart thrive by offering near-infinite selection and leveraging Chinese sellers to expand their catalogs, Etsy remains focused on a narrow vertical—handmade and vintage items—whose demand appears to be waning according to current indicators.

Data reveals that not only has Etsy's pandemic-fueled explosive growth come to a halt, but it has now reversed itself. The key question now is whether this represents a reasonable scaling back after unsustainable expansion during the pandemic or signals a more concerning long-term trend for the handmade market.